REGISTRO DOI: 10.69849/revistaft/ni10202507211216

Priscilla Godoy Lobato Barcelos

Abstract

Effective cash flow management is a critical determinant of sustainability and success for microentrepreneurs, who typically operate with limited capital, informal structures, and fluctuating revenue streams. This article explores the core financial challenges faced by microenterprises and presents practical strategies to strengthen their cash flow. Drawing from established financial management literature and empirical studies, it emphasizes the role of a solid business plan in forecasting cash needs, the importance of strict expense control, and the implementation of efficient receivables management. The paper also highlights the growing significance of digital financial tools in facilitating real-time financial monitoring, decision-making, and transparency. Furthermore, it addresses the value of building a financial buffer to withstand external shocks and unpredictable income fluctuations. By adopting these practices, microentrepreneurs can improve financial discipline, reduce liquidity risks, and foster long-term business resilience. The findings contribute to the discourse on inclusive entrepreneurship and the empowerment of small-scale economic actors in both emerging and developed economies.

Keywords: Cash flow management, microentrepreneurs, financial planning, expense control, digital tools, business resilience, small enterprises.

Cash flow management represents one of the most critical yet challenging aspects of running a microenterprise. Microentrepreneurs—defined as individuals operating very small businesses with limited financial and human resources—often encounter erratic income streams, low bargaining power with suppliers and customers, and limited access to external funding. As noted by Fatoki (2012), one of the primary reasons for the failure of micro and small enterprises in developing countries is the lack of financial planning and poor cash flow control. For such businesses, maintaining a positive cash flow is not merely a sign of good financial health; it is a prerequisite for survival.

One of the foundational steps toward effective cash flow management is the development of a solid business plan. A comprehensive business plan provides more than a vision for growth—it outlines a firm’s operational and financial trajectory, including realistic revenue projections, cost estimates, and contingency reserves. Barrow, Barrow, and Brown (2012) emphasize that a business plan not only helps entrepreneurs understand the economic viability of their venture but also supports day-to-day financial decision-making. By forecasting monthly cash inflows and outflows, microentrepreneurs can anticipate periods of surplus or deficit and make informed decisions, such as postponing discretionary expenses or seeking short-term financing. This forward-looking approach is especially vital in environments characterized by uncertainty and seasonal variation in demand.

Another essential practice is rigorous expense control. Microentrepreneurs must pay close attention to how every unit of currency is spent and ensure that all expenditures contribute meaningfully to business operations or long-term growth. According to Brigham and Ehrhardt (2016), one of the key drivers of liquidity and profitability in small enterprises is the efficient management of operational costs. Fixed costs such as rent and utilities should be carefully negotiated and reviewed regularly, while variable costs, including inventory purchases and transportation, should be optimized through economies of scale or strategic partnerships. Even small reductions in recurrent costs can significantly improve cash flow over time. It is also advisable for microentrepreneurs to periodically audit their expenses to identify potential leakages and implement corrective actions.

Equally important is the management of receivables. Delayed customer payments can have a disproportionately negative effect on microenterprises, which often lack the financial cushion to absorb such delays. Ng, Smith, and Smith (1999) highlight that the structure of trade credit and the management of accounts receivable are central to the liquidity of small firms. To address this, microentrepreneurs should establish clear and enforceable payment terms, issue invoices promptly, and follow up consistently on overdue accounts. Incentivizing early payment—through small discounts or added value—can also improve cash inflows. Furthermore, diversifying the customer base helps reduce dependency on a few clients and minimizes the impact of defaults or late payments from individual buyers. Using mobile payment systems and digital invoicing platforms can also facilitate faster transactions and improved tracking of receivables.

The adoption of digital financial tools has become increasingly relevant in recent years, especially as mobile and cloud-based technologies have become more accessible. Applications such as QuickBooks, Zoho Books, and ContaAzul offer user-friendly interfaces that help microentrepreneurs track income, expenses, and account balances in real time. According to the Organisation for Economic Co-operation and Development (OECD, 2019), the use of digital technologies by small and medium-sized enterprises enhances their financial transparency, improves efficiency, and enables better decision-making under uncertainty. These platforms often include cash flow forecasting features and dashboards that allow entrepreneurs to visualize their financial status at a glance, reducing reliance on manual calculations and improving the overall quality of financial management.

A final but often overlooked element of cash flow management is the accumulation of a financial buffer. Microentrepreneurs should aim to build a modest cash reserve to manage unexpected events such as economic downturns, equipment breakdowns, or loss of key customers. Perry and Welsh (2002) argue that small businesses with some level of financial slack—defined as uncommitted liquid resources—are more resilient and capable of adapting to external shocks. Although saving money may seem difficult for businesses with tight margins, even small and consistent savings can gradually create a safety net. Setting aside a fixed percentage of monthly income in a separate emergency fund or using digital saving tools that automate the process can promote discipline and financial resilience.

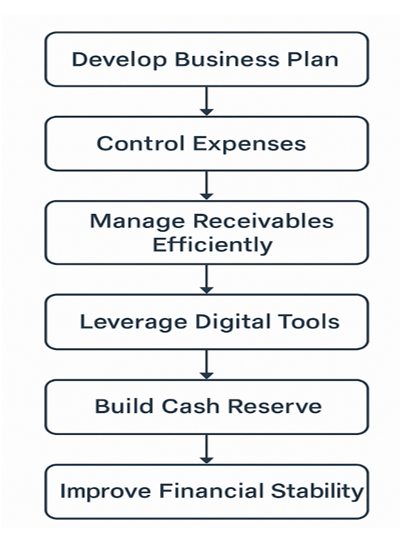

The flowchart illustrates a practical roadmap for effective cash flow management tailored to microentrepreneurs. It begins with the development of a business plan, which provides financial direction and forecasting. Next, it emphasizes controlling expenses to maintain liquidity and reduce unnecessary spending. Efficient management of receivables ensures timely cash inflows, minimizing the risk of payment delays. The adoption of digital tools is highlighted as a means to enhance financial tracking and decision-making. Building a cash reserve is the penultimate step, offering protection against unforeseen disruptions. Finally, these combined efforts lead to improved financial stability, enabling long-term business sustainability.

Figure 1. Cash Flow Management Process for Microentrepreneurs.

In conclusion, managing cash flow is a dynamic, multifaceted challenge that requires strategic planning, disciplined execution, and a proactive mindset. For microentrepreneurs, who often operate under tight constraints, the ability to project future cash needs, control spending, enforce payment discipline, leverage digital tools, and build reserves is indispensable. These strategies are not only supported by the academic literature but have also been proven effective in practice across diverse economic settings. As the global economy continues to evolve, equipping microentrepreneurs with financial literacy and practical tools for cash flow management will remain a key factor in fostering inclusive economic development and long-term business sustainability.

References

Barrow, C., Barrow, P., & Brown, R. (2012). The Business Plan Workbook: A Step-by-Step Guide to Creating and Developing a Successful Business (7th ed.). London: Kogan Page.

Brigham, E. F., & Ehrhardt, M. C. (2016). Financial Management: Theory & Practice (15th ed.). Boston: Cengage Learning.

Fatoki, O. (2012). An investigation into the financial management practices of new micro-enterprises in South Africa. Journal of Social Sciences, 33(2), 179–188.

Ng, C. K., Smith, J. K., & Smith, R. L. (1999). Evidence on the determinants of credit terms used in interfirm trade. The Journal of Finance, 54(3), 1109–1129.

OECD. (2019). The Digital Transformation of SMEs. OECD Studies on SMEs and Entrepreneurship. Paris: Organisation for Economic Co-operation and Development.

Perry, S. C., & Welsh, D. H. (2002). The relationship between planning and performance in small firms. International Journal of Entrepreneurship and Innovation, 3(1), 5–15.

Silva, J. F. (2024). SENSORY-FOCUSED FOOTWEAR DESIGN: MERGING ART AND WELL-BEING FOR INDIVIDUALS WITH AUTISM. International Seven Journal of Multidisciplinary, 1(1). https://doi.org/10.56238/isevmjv1n1-016

Silva, J. F. (2024). SENSORY-FOCUSED FOOTWEAR DESIGN: MERGING ART AND WELL-BEING FOR INDIVIDUALS WITH AUTISM. International Seven Journal of Multidisciplinary, 1(1). https://doi.org/10.56238/isevmjv1n1-016

Silva, J. F. (2024). Enhancing cybersecurity: A comprehensive approach to addressing the growing threat of cybercrime. Revista Sistemática, 14(5), 1199–1203. https://doi.org/10.56238/rcsv14n5-009

Venturini, R. E. (2025). Technological innovations in agriculture: the application of Blockchain and Artificial Intelligence for grain traceability and protection. Brazilian Journal of Development, 11(3), e78100. https://doi.org/10.34117/bjdv11n3-007

Turatti, R. C. (2025). Application of artificial intelligence in forecasting consumer behavior and trends in E-commerce. Brazilian Journal of Development, 11(3), e78442. https://doi.org/10.34117/bjdv11n3-039

Garcia, A. G. (2025). The impact of sustainable practices on employee well-being and organizational success. Brazilian Journal of Development, 11(3), e78599. https://doi.org/10.34117/bjdv11n3-054

Filho, W. L. R. (2025). The Role of Zero Trust Architecture in Modern Cybersecurity: Integration with IAM and Emerging Technologies. Brazilian Journal of Development, 11(1), e76836. https://doi.org/10.34117/bjdv11n1-060

Antonio, S. L. (2025). Technological innovations and geomechanical challenges in Midland Basin Drilling. Brazilian Journal of Development, 11(3), e78097. https://doi.org/10.34117/bjdv11n3-005

Moreira, C. A. (2025). Digital monitoring of heavy equipment: advancing cost optimization and operational efficiency. Brazilian Journal of Development, 11(2),e77294. https://doi.org/10.34117/bjdv11n2-011 Brazilian Journal of Development, Curitiba, v.9, n.6, p. 18723-18728, jun., 2023

Delci, C. A. M. (2025). THE EFFECTIVENESS OF LAST PLANNER SYSTEM (LPS) IN INFRASTRUCTURE PROJECT MANAGEMENT. RevistaSistemática, 15(2), 133–139. https://doi.org/10.56238/rcsv15n2-009

SANTOS, Hugo; PESSOA, Eliomar Gotardi. Impacts of digitalization on the efficiency and quality of public services: A comprehensive analysis. LUMENETVIRTUS, [S.l.],v.15,n.40,p.4 4094414,2024. DOI: 10.56238/levv15n40024. Disponível em: https://periodicos.newsciencepubl.com/LEV/article/view/452. Acesso em: 25 jan.2025.

Freitas, G. B., Rabelo, E.M., & Pessoa, E.G.(2023). Projeto modular com reaproveitamento de container marítimo. Brazilian Journal of Development,9 (10), 28303–28339.https://doi.org/10.34117/bjdv9n10057

Freitas, G. B., Rabelo, E. M., & amp; Pessoa, E.G (2023). Projeto modular com reaproveitamento de container marítimo. Brazilian Journal of Development,9 (10), 28303–28339.https://doi.org/10.34117/bjdv9n10057

Pessoa, E.G., Feitosa, L. M., e Padua, V.P., & amp; Pereira, A. G.(2023). Estudo dos recalques primários em um aterro executado sobre a argila mole do Sarapuí. Brazilian Journal of Development, 9(10), 28352–28375. https://doi.org/10.34117/bjdv9n10059

PESSOA, E.G.; FEITOSA, L.M. ;PEREIRA, A.G.; EPADUA, V.P. Efeitos de espécies de al na eficiência de coagulação, Al – residual e propriedade dos flocos no tratamento de águas superficiais. Brazilian Journal of Health Review,[S.l.], v.6,n.5,p.2481424826,2023. DOI: 10.34119/bjhrv6n5523. Disponível em: https://ojs.brazilianjournals.com.br/ojs/index.php/BJHR/article/view/63890. Acesso em: 25 jan. 2025.

SANTOS, Hugo; PESSOA, Eliomar Gotardi. Impacts of digitalization on the efficiency and quality of public services: A comprehensive analysis. LUMENETVIRTUS, [S.l.], v.15, n.40, p.4 4094414,2024. DOI: 10.56238/levv15n40024. Disponível em: https://periodicos.newsciencepubl.com/LEV/article/view/452. Acesso em: 25jan. 2025.

Filho, W. L. R. (2025). The Role of Zero Trust Architecture in Modern Cybersecurity: Integration with IAM and Emerging Technologies. Brazilian Journal of Development, 11(1), e76836. https://doi.org/10.34117/bjdv11n1-060

Oliveira, C. E. C. de. (2025). Gentrification, urban revitalization, and social equity: challenges and solutions. Brazilian Journal of Development, 11(2), e77293. https://doi.org/10.34117/bjdv11n2-010

Pessoa, E. G. (2024). Pavimentos permeáveis uma solução sustentável. Revista Sistemática, 14(3), 594–599. https://doi.org/10.56238/rcsv14n3-012

Filho, W. L. R. (2025). THE ROLE OF AI IN ENHANCING IDENTITY AND ACCESS MANAGEMENT SYSTEMS. International Seven Journal of Multidisciplinary, 1(2). https://doi.org/10.56238/isevmjv1n2-011

Antonio, S. L. (2025). Technological innovations and geomechanical challenges in Midland Basin Drilling. Brazilian Journal of Development, 11(3), e78097. https://doi.org/10.34117/bjdv11n3-005

Pessoa, E. G. (2024). Pavimentos permeáveis uma solução sustentável. Revista Sistemática, 14(3), 594–599. https://doi.org/10.56238/rcsv14n3-012

Pessoa, E. G. (2024). Pavimentos permeáveis uma solução sustentável. Revista Sistemática, 14(3), 594–599. https://doi.org/10.56238/rcsv14n3-012

Eliomar Gotardi Pessoa, & Coautora: Glaucia Brandão Freitas. (2022). ANÁLISE DE CUSTO DE PAVIMENTOS PERMEÁVEIS EM BLOCO DE CONCRETO UTILIZANDO BIM (BUILDING INFORMATION MODELING). Revistaft, 26(111), 86. https://doi.org/10.5281/zenodo.10022486

Eliomar Gotardi Pessoa, Gabriel Seixas Pinto Azevedo Benittez, Nathalia Pizzol de Oliveira, & Vitor Borges Ferreira Leite. (2022). ANÁLISE COMPARATIVA ENTRE RESULTADOS EXPERIMENTAIS E TEÓRICOS DE UMA ESTACA COM CARGA HORIZONTAL APLICADA NO TOPO. Revistaft, 27(119), 67. https://doi.org/10.5281/zenodo.7626667

Eliomar Gotardi Pessoa, & Coautora: Glaucia Brandão Freitas. (2022). ANÁLISE COMPARATIVA ENTRE RESULTADOS TEÓRICOS DA DEFLEXÃO DE UMA LAJE PLANA COM CARGA DISTRIBUÍDA PELO MÉTODO DE EQUAÇÃO DE DIFERENCIAL DE LAGRANGE POR SÉRIE DE FOURIER DUPLA E MODELAGEM NUMÉRICA PELO SOFTWARE SAP2000. Revistaft, 26(111), 43. https://doi.org/10.5281/zenodo.10019943

Pessoa, E. G. (2025). Optimizing helical pile foundations: a comprehensive study on displaced soil volume and group behavior. Brazilian Journal of Development, 11(4), e79278. https://doi.org/10.34117/bjdv11n4-047

Pessoa, E. G. (2025). Utilizing recycled construction and demolition waste in permeable pavements for sustainable urban infrastructure. Brazilian Journal of Development, 11(4), e79277. https://doi.org/10.34117/bjdv11n4-046