REGISTRO DOI: 10.69849/revistaft/dt10202212272223

Rafael Elias Venturini

Abstract

The implementation of advanced technologies, such as Artificial Intelligence (AI), has a transformative impact on the agricultural sector, providing producers with innovative tools to tackle price volatility and enhance operational efficiency. AI, with its machine learning capabilities and predictive analytics, allows farmers to anticipate price trends, optimize supply chain management, and personalize negotiation strategies, facilitating more strategic decision-making. The combination of technological innovations with effective public policies, such as the Violent Market Price (VMP) contracts and agricultural insurance models, can provide economic security and stability in the agricultural market. These approaches help mitigate price fluctuation risks, protect producers’ income, and promote long-term financial sustainability. The dissemination of information on prices and agricultural practices is also crucial, especially in developing countries, where a lack of data is a significant barrier to efficient production management. Furthermore, agricultural subsidy policies, such as price loss coverage and agricultural risk, play a vital role in stabilizing production and protecting farmers from economic crises. Adapting to market fluctuations and using pre-season repurchase contracts are promising strategies to balance disparities in producer well-being. Research on domestic currency depreciation and its effects on agricultural exports also provides insights into the interaction between macroeconomic variables and the agricultural market. In summary, the integration of emerging technologies with robust policy strategies can ensure stability and sustainable growth in the agricultural sector.

Keywords: Artificial Intelligence, Price Volatility, Sustainable Agriculture, Public Policies, Technological Innovation.

Price volatility in agricultural markets presents a persistent challenge for farmers, who frequently face product devaluation due to seasonal fluctuations, climate change, and economic shifts. In this context, Artificial Intelligence (AI) offers a transformative solution, helping farmers adopt more effective strategies to mitigate the impact of market fluctuations and protect their income. Through machine learning algorithms and predictive data analysis, AI enables farmers to anticipate price trends by identifying historical patterns and key external variables. Equipped with this real-time information, farmers can make more informed decisions, such as timing the sale of their products or adjusting production according to forecasted demand and price trends, thereby minimizing losses caused by market devaluation.

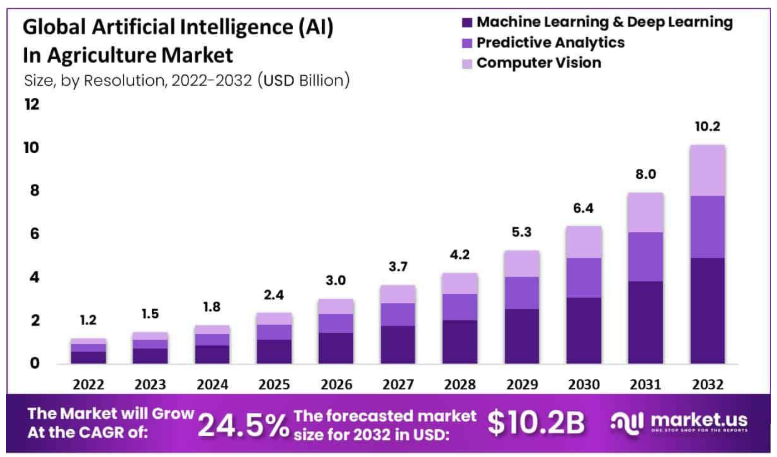

Source: Market.us.

Furthermore, AI can significantly enhance supply chain management by identifying inefficiencies and bottlenecks that could affect production costs and product availability. This allows farmers to optimize their operations, reduce waste, improve storage and transportation processes, and ensure that products reach markets in optimal condition. Such improvements increase the chances of securing more competitive prices. Additionally, AI can tailor negotiation strategies, helping farmers communicate more effectively with buyers and distributors. By analyzing market sentiment and buyer behavior, AI enables farmers to anticipate the needs of their clients and adjust their proposals accordingly, leading to better commercial agreements and greater control over sales prices.

In summary, AI-based solutions empower farmers with innovative tools to better predict and manage price devaluation, fostering smarter, more strategic product management and ensuring long-term financial sustainability. As AI technology continues to evolve, its benefits are becoming increasingly accessible, enabling farmers to adapt more efficiently to the demands of a dynamic and unpredictable market.

The study by Rajput and Venkataraman (2021) examines a crucial mechanism in the development of the agribusiness sector: supply contracts between farmers and firms. A key challenge in such agreements is the risk of violations due to significant price fluctuations. To address this, the authors propose a Violent Market Price (VMP) contract, which adjusts prices during adverse market conditions to encourage both parties to honor the agreement. The VMP contract, modeled as a Stackelberg game, provides an optimal framework for ensuring adherence, demonstrating that both farmers and firms achieve higher profits when they comply with the contract compared to when they violate it. This approach also includes a sensitivity analysis to provide further insights into its practical application.

Similarly, the research by Chen and Tang (2015) investigates the impact of information dissemination on the economic outcomes of farmers in developing countries, where a lack of market data often hinders informed decision-making. The study explores how providing market prices, crop advisory, and agricultural techniques through NGOs and for-profit organizations can help alleviate poverty. The results show that private and public information signals significantly enhance farmers’ welfare by improving their decision-making, especially when private signals are imprecise. In certain cases, public signals may reduce welfare inequality among farmers, although their impact diminishes when private signals are already available.

Alizamir, Iravani, and Mamani (2018) analyze the impact of U.S. agricultural subsidy programs, focusing on the Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC) policies. These programs are designed to safeguard farmers’ income by providing subsidies when prices fall below a certain threshold or when revenue drops. The study concludes that the PLC incentivizes farmers to plant more acreage, while the ARC may lead to reduced planting and a smaller crop supply. Interestingly, the study finds that both farmers and consumers can benefit more from the PLC across a range of parameter values, even when the reference price is relatively low.

In a review by Cole and Xiong (2017), recent advancements in agricultural insurance (AI) for developing countries are discussed. The study highlights the challenges faced by agricultural producers in these regions, including the risk of crop failure and market price fluctuations. The authors explore how insurance innovations that link payouts to actual weather conditions have led to new research in the field. They focus on how AI helps farmers manage risk, make investment decisions, and smooth their income and consumption, offering valuable insights into the role of AI in promoting agricultural sustainability.

Hu, Liu, and Wang (2019) investigate how price fluctuations in agricultural markets affect poverty reduction for small-scale farmers. Their study develops a model to understand how farmers with different production costs make planting decisions over time. The authors distinguish between strategic farmers, who anticipate future price changes, and naïve farmers, who react impulsively to recent prices. The research shows that fostering a sufficient number of strategic farmers can reduce price volatility and enhance overall social welfare. The study also explores the potential of preseason buyout contracts, which can benefit both farmers and firms by equalizing welfare and reducing disparities among farmers with varying production costs.

Ali (2020) examines the effects of domestic currency depreciation on agricultural exports from Pakistan. The study finds that currency depreciation positively impacts both the price and quantity margins of agricultural exports. The research shows that the intensive margin, driven by price increases, plays a more significant role than quantity changes. Depreciation also broadens the extensive margins, allowing firms to expand their product offerings and reach new clients in existing markets. The study underscores the importance of factors such as firms’ exporting experience, trade orientation, and exchange rate regimes in shaping these responses.

In conclusion, the implementation of advanced technologies, such as Artificial Intelligence (AI), has the potential to profoundly transform the agricultural sector by providing producers with innovative tools to tackle the challenges of price volatility and improve the efficiency of their operations. AI, with its capabilities in machine learning and predictive data analysis, offers farmers the ability to anticipate price trends, optimize supply chain management, and personalize negotiation strategies, allowing them to make more assertive and strategic decisions. This not only contributes to maximizing profitability but also provides a way to mitigate the impacts of price depreciation and ensure long-term financial sustainability.

In summary, the combination of technological innovations, such as AI, with effective public policies, contract models adapted to the agricultural market reality, and the provision of relevant information, has the potential to provide smarter and more strategic management for farmers. Such approaches not only help mitigate risks and market fluctuations but also contribute to promoting sustainability and equity in the agricultural sector. As the agricultural sector continues to face the challenges of climate change, globalization, and economic fluctuations, the ability to adapt and innovate will be crucial to ensuring the sector’s stability and long-term growth.

References

Ali, S. (2020). Exchange Rate Effects on Agricultural Exports: Transaction‐Level Evidence from Pakistan. American Journal of Agricultural Economics, 102, 1020-1044. https://doi.org/10.1002/ajae.12027.

Alizamir, S., Iravani, F., & Mamani, H. (2019). An Analysis of Price vs. Revenue Protection: Government Subsidies in the Agriculture Industry. Manag. Sci., 65, 32-49. https://doi.org/10.1287/mnsc.2017.2927.

Chen, Y., & Tang, C. (2015). The Economic Value of Market Information for Farmers in Developing Economies. Production and Operations Management, 24, 1441 – 1452. https://doi.org/10.1111/poms.12371.

Cole, S., & Xiong, W. (2017). Agricultural Insurance and Economic Development. Annual Review of Economics, 9, 235-262. https://doi.org/10.1146/ANNUREV-ECONOMICS-080315-015225.

Hu, M., Liu, Y., & Wang, W. (2019). Socially Beneficial Rationality: The Value of Strategic Farmers, Social Entrepreneurs, and For-Profit Firms in Crop Planting Decisions. Manag. Sci., 65, 3654-3672. https://doi.org/10.1287/MNSC.2018.3133.

Rajput, R., & Venkataraman, S. (2021). A violent market price contract for agribusiness supply chain. Annals of Operations Research, 315, 1971-1996. https://doi.org/10.1007/S10479-021-04068-2.