REGISTRO DOI: 10.69849/revistaft/ar10202411100913

Isabela Oliveira¹

Luan Santos¹,²

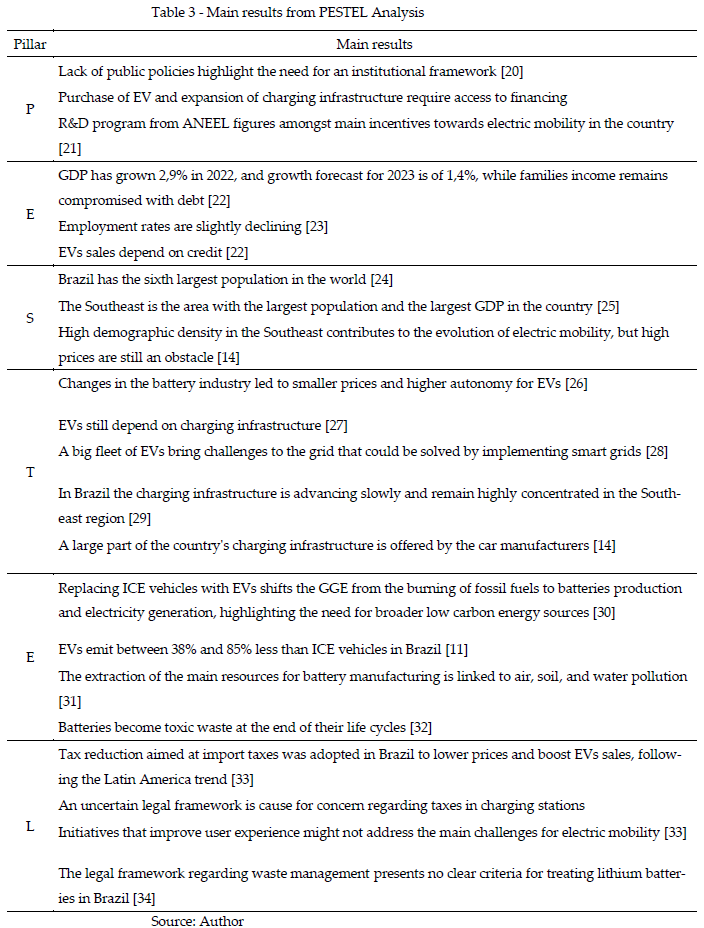

Abstract: Climate change is one of the biggest political and economic challenges faced by global economy. To slow down climate change, mitigation actions and greenhouse gas (GHG) emission targets have been adopted, promoting electric vehicles (EVs) globally. In Brazil, however, emission reduction strategies for the transport sector are based on the broad use of biofuels. This paper studies the Brazilian light-duty vehicle EVs market investigating the reasons behind its current state. A Structure-Conduct-Performance Model with a PESTEL Analysis and the Herfindahl–Hirschman Index integrated to the structure analysis was used. The Brazilian EV market has grown in the period from 2019 to 2023, albeit timidly and restricted to a luxury market. The lack of actions promoting electric mobility, a less than promising economic scenario, the challenges in implementing a charging infrastructure and the conduct of the incumbent firm in the market – investing in high priced hybrid models – contribute to low penetration of EVs in the market and the dominance of hybrids amongst them. In the light of these findings, this study highlights that the Brazilian EVs market would benefit from public policies developed to promote electric mobility, and investment of private companies to develop EV models with more competitive prices.

Keywords: Electric vehicles; Structure-Conduct-Performance; PESTEL; Herfindahl–Hirschman Index

1. Introduction

Climate change has been identified as one of the greatest political and economic challenges facing the global economy [1]. The global mobilization against climate change was marked by the 2030 Agenda, the Paris Agreement and the Paris Declaration and Call for Action on Electromobility and Climate Change, which highlighted the adoption of decarbonization goals, including energy transition actions to reduce greenhouse gases (GHG) emissions and requiring that global fossil fuel consumption reaches its peak in 2025, starting a significant reduction from that moment on [2].

This context contributed to exponential growth in the electric vehicle (EV) market, with sales surpassing the 10-million-unit mark in 2022 [3]. In Brazil, however, the transport sector’s emissions reduction strategy is heavily based on the large-scale adoption of biofuels, as expressed in its Nationally Determined Contribution (NDC) [4].

Brazil has a long history of biofuel programs that date back to 1975, when the PROALCOOL program was launched to increase the country’s energy independence [5]. The program was the first in a series of policies to encourage the use of biofuels in the country and in the 1990s cars that ran on both ethanol and gasoline began to be sold in the country, reaching up to 72.7% of the country’s circulating fleet in 2021, while those powered only by gasoline represented 15.6% of the fleet, those powered by diesel represented 11% and hybrid and electric vehicles represented 0.1% [6].

Brazil is highly dependent on road transport [7], and the vehicle fleet in 2021 reached 46.6 million units, including cars, light commercial trucks, and buses [6]. The main source of energy in the transport sector in the country are petroleum derivatives, making the sector responsible for approximately 32.5% of the country’s energy consumption in 2021 and 44.4% of total emissions from the energy sector [8].

Increasing the share of electricity in the Brazilian transport matrix would contribute to energy security and the reduction of emissions in the sector [9], considering that the Brazilian electrical matrix is 44.7% renewable, above the global average [8]. EVs also reduce noise pollution, especially in large cities [10].

Although the global trend points to EVs eventually dominating the market, the dominance of biofuels in Brazil combined with the size of the national market could cause the Brazilian market to remain in a path that diverges from that of most countries for a long period. The Brazilian NDC does not mention electric mobility, and its progress in the country is challenged by the lack of state commitment to the agenda, high import taxes and the opposition represented by the biofuels lobby [11].

This paper analyzes the Brazilian EV market with a focus on light vehicles, aiming to understand the determining factors of its current state and suggest measures that could enhance its development. To this end, a Structure-Conduct-Performance Model was applied integrated with a PESTEL analysis and the calculation of the Herfindahl–Hirschman Index (IHH). The research is divided into 5 sections: in this first one (Section 1), we present a brief background and purpose of the research. Section 2 details the methodological procedure. Section 3 exposes the main results of the research. Section 4 discusses the implications of these results for the markets further development. Finally, Section 5 summarizes the main findings of the study.

2. Materials and Methods

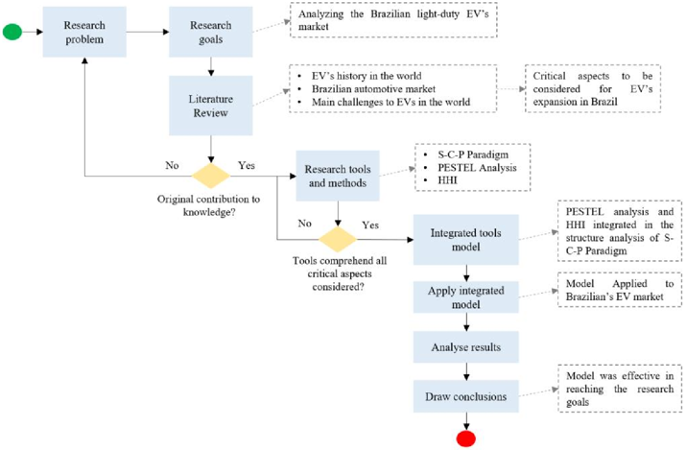

This paper consisted in five steps: (i) Planning; (ii) Contextualizing; (iii) Developing; (iv) Applying and (v) Conclusion. The first step was centered in defining the scop and goals of the work. The second step consisted in gathering background information, allowing to better understand the market and to select the appropriate methods and tools to answer the research question. In this step the S-C-P paradigm was chosen, as well as the PESTEL analysis and the HHI – to support the structure analysis of the S-C-P paradigm. The third step consisted in the development of the integrated model, combining the chosen tools. The fourth step was the application of this model, generating the main results of this paper. The fifth step was drawing conclusions from these results. The steps are detailed in the flow chart of the research in Figure 1.

Figure 1 – Research flow chart

The S-C-P paradigm is a useful analytical framework for sector analysis due to its capacity to articulate variables analyze the market power of firms [12]. The three pillars of the paradigm analyze the factors outside the organization, including socioeconomic variables (structure), the factors inside the organization, represented by its strategy (conduct) and the result of the interaction of these factors (performance), as well as how each pillar recursively influences the other two [13].

In this study, the contextualization step highlighted the pivotal importance of factors belonging to the structure pillar to achieve the research goal. This realization led to the integration of the PESTEL analysis and the HHI to the structure pillar of the S-C-P paradigm, providing a more holistic framework and a quantitative interpretation of the market concentration, respectively.

2.1. PESTEL analysis

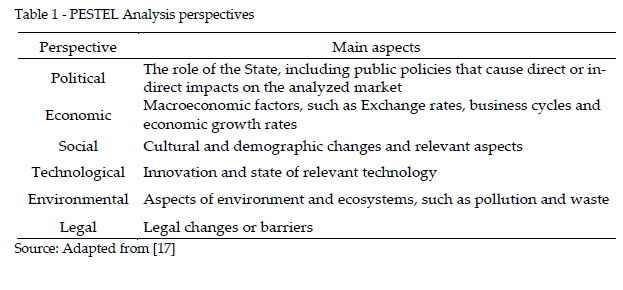

The PESTEL framework is a strategic analysis tool [14] for macroeconomic variables, identifying risks and opportunities for a business [15]. The name of the tool is an acronym in which each letter means, respectively, political, economic, social, technologic, environmental, and legal – the different perspectives that the framework encompasses. It consists in a holistic approach to identify and understand external conditions that might impact industries and the performance of companies [16]. A brief definition of each considered perspective can be observed in Table 1.

2.2. The Herfindahl-Hirschman Index

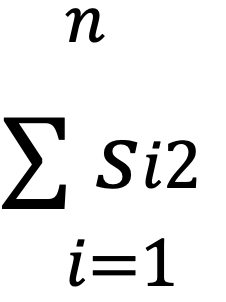

The HHI is the most broadly used metric for assessing market concentration. Consists in the sum of the squared market share of every firm active in the analyzed market, provided these shares are expressed in percentages [19]. Using the squared value of the market share implies that relatively bigger companies will have bigger weight [18]. Therefore, the higher the HHI value the more concentrated the market [19]. The HHI formula can be observed as follows:

Where s is the market share of each of the n companies in the market.

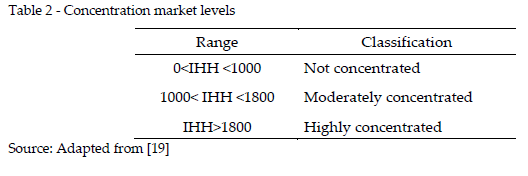

In anti-trust scenarios the HHI is calculated based on percentual market shares, with the index value varying from 0 to 10.000. The Merger Guidelines proposes three ranges to interpret if a fusion between companies is of concern for the competition level in the industry. In Brazil, the Central Bank proposes similar ranges to classify the concentration level in a market. The ranges can be observed in Table 2.

In this paper, the range proposed by the Central Bank of Brazil was adopted do evaluate the concentration level of the EV market.

3. Results

This section presents the results of the integrated model generated by the embedding of the PESTEL analysis and the HHI in the structure pillar. The insights gathered from this integrated analysis contributed for the discussion of the remaining two – conduct and performance. The following subsections will present the results from each pillar.

3.1. Structure

3.1.1. PESTEL Analysis

Despite the growth in electric mobility themed public policies in Brazil, the Brazilian EV market is distinguished by political and economic aspects that largely differ from the ones observed in more developed EV markets such as China, EU, and North America [20]. In these markets the issues of high prices and low autonomy of the EVs are dealt with by public policies, while Brazil struggles to build a strong legal and institutional framework that supports electric mobility and the country’s climate related policies lack electric mobility goals [10].

In Brazil, EVs are still largely imported. Initiatives aimed at increasing the amount of EVs in the fleet are still limited, and don’t properly connect with the existent framework, with direct actions from federal agencies failing to integrate strategic national plans [10]. The main incentive to EVs in the country consists in the tax reduction aimed at import taxes to lower the price of EVs, but policies that properly incentivize the development and production of EVs in the country are still lacking. The current administration – that will be in place from 2023 to the end of 2026 – has been showing positive signs towards electric mobility and energy transition [23;37]. These advances are, however, mostly aimed at public transportation, with light-duty vehicles being left off recent developments.

This scarcity of subsidies contributes to persistent high prices for EVs in the country, where even traditional ICE vehicles purchase largely depends on credit [37]. Between December of 2022 and February of 2023, however, the credit granted to both companies and individuals for acquiring assets has declined [22], which could hinder the growth in EVs sales.

The decrease in available credit happens in a moment where unemployment rates have grown [23], families are largely in debt [22] and GDP has grown 2,9% with the rate of investment falling slightly from 18,9% to 18,8% in comparison with the previous year [38]. Growth in GDP and credit offer contribute to a higher demand for cars in Brazil, as do lower import taxes [39].

Lower import taxes and guarantee of maintenance costs similar to the ones from ICE vehicles have a large impact on the consumers perspective of EVs in Brazil [39; 41], following the trend observed in China and Europe [42-45]. It is expected that, following the example of these markets, economic incentives (such as lower import and recurrent taxes and discounts on electricity prices for EV owners), a deeper understanding of the environmental benefits of EVs, a broader availability of charging points and technologic advances leading to higher battery performance bolster the demand for EVs in Brazil [39; 41].

Worldwide the battery industry has been evolving quickly, leading to an 89% drop in battery prices since 2010 [26] and an increase in autonomy for EVs, reaching 400km autonomy for some models – a similar performance to ICE vehicles [14]. Nonetheless, EVs still depend on the existence and reliability of charging infrastructure, which poses a challenge to the current grid in a large country like Brazil [27].

A flexible, resilient, efficient, economical, and reliable grid demands digital technologies to enable its management. Such grids are commonly known as smart grids and could be the answer to the challenge that many EVs in the fleet would represent [27]. The usage of smart charging – adapting the recharging cycle of EVs to the grid’s conditions and the car owner’s needs – could further enhance the grid’s capability of absorbing the demand imposed by EVs [28].

Once the grid has the capacity, the implementation of the charging infrastructure per se remains – a challenge in a country as large as Brazil. The amount of charging points has been evolving, going from 226 in the end of 2019 to 1250 in February of 2022, but this growth remains concentrated in the Southeast, coinciding with the region of higher income and higher EV’s concentration [26; 29]. So far, most of this charging infrastructure is offered by the car manufacturers themselves [14] and by energy companies [46].

Aside from the flexibility and resilience of the grid, many EVs in the fleet will increase energy consumption – leading to the need of expanding the grid’s capacity. To guarantee the lower GGE promised by the EVs, however, this expansion must be supported by the lowest emissions energy sources possible, granted that EVs will shift the emissions from the burning of fossil fuels to batteries production and energy generation.

This shift points to the need of considering the entire life cycle of the vehicle when evaluating the environmental benefits and impacts of EVs [30]. Such assessment reveals that, in Brazil, EVs emissions are 38% to 85% lower than ICE emissions [11]. Other environmental impacts should, however, be considered, such as water usage, natural resources depletion, contamination of the soil and damage to human health due to the battery’s toxicity [47].

The main natural resources for manufacturing batteries are cobalt and lithium – resources with air, soil, and water pollution linked to its mining [31], as well as impacts over biodiversity, human health, water consumption and local communities (FARJANA; HUDA; MAHMUD, 2019; FARJANA; MAHMUD, 2012 apud DALL-ORSOLETTA; FERREIRA; GILSON DRANKA, 2022). The main strategy to reduce these impacts is a broad and comprehensive reusing and recycling of batteries from EVs [49]. In Brazil, however, neither the infrastructure nor the necessary legal framework exists.

In a closer look, a sound legal framework granting tax benefits, clear and standardized fast-charging regulations, and an adequate waste management system for the batteries is necessary to both increase the number of EVs in the fleet and reduce the risks of the electric mobility advancing in the country [34].

3.1.2. Market concentration and the HHI

Throughout history, the automobile market has been considered difficult to enter, with barriers such as economies of scale, cumulative effect of the learning curve, product complexity, sophisticated supply chain and high input capital contributing for incumbent firms to maintain the dominant position in the market [50; 51].

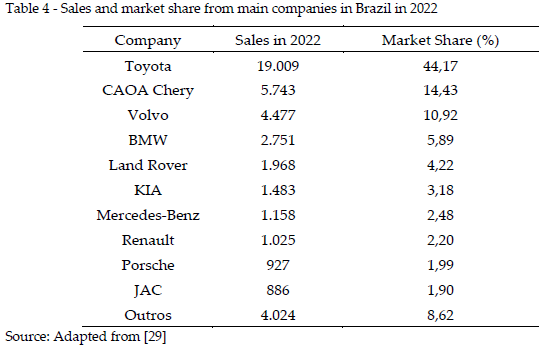

The simpler architecture of EVs and a passive attitude from ICE vehicle’s companies contributed for these barriers to become meeker, especially in markets supported by public policies aiming to increase competition [52]. In Brazil, however, the scarcity of public incentive contributes for the market to remain highly concentrated. The market share of the main companies in the EV Brazilian market in 2022 can be observed in Table 4.

The HHI was calculated considering the market share of all the companies in the market. As expected from the data in Table 4, the market was classified as highly concentrated, with a HHI value of 2366,73. This portrait is further reinforced by net effects [51], such as the lack of charging infrastructure contributing for the EV’s Brazilian market to be less attractive for companies.

3.2. Conduct

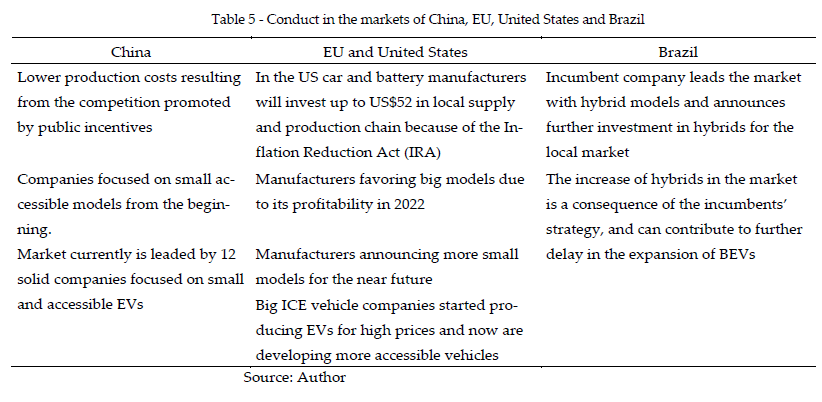

Public policies can largely influence the firm’s conducts. The main trend of conduct in China, Europe, United States and Brazil can be observed in Table 5.

In the United States car and battery manufacturers will invest up to US$52 in local supply and production chain because of the Inflation Reduction Act (IRA), in a similar trend to Thailand and Indonesia [3]. In both North America and the European Union (EU), in 2022, large models have gained space in the market in 2022, prioritized by companies because of their higher profitability – although European manufacturers are announcing more accessible models for the next years as a means of accessing broader markets [3; 53; 54].

Both markets feature traditional ICE vehicle companies bringing EVs to the market for initially high prices and now seeking to develop more accessible models. In the United States Tesla produces and sells exclusively EVs and has a large market share, however, even Tesla entered the market with high price models, later trying to develop models with more competitive prices [3].

In China the trend was reverse – companies developed cost competitive models first, supported by public policies, later working on higher autonomy and other features. Nowadays the market is composed by more than 10 companies that produce small and cheap models [3].

In Brazil 42,03% of the sales in 2022 belonged to Toyota, that sells hybrid flex fuel models [55] and recently announced the intention to invest R$1,7 billion in developing a new hybrid flex fuel for the Brazilian market – from which approximately R$1 billion result from tax concessions from the state of São Paulo [56].

3.3. Performance

From 1998 to 2018 694 EV related patent requests were placed in Brazil from 135 different authors – none of which were Brazilian companies. The company with most requests was Toyota, and the ten biggest authors were responsible for over 65% of the requests. Most of these requests, however, remain pending [57].

Toyota nowadays leads the EV Brazilian market, answering for over 40% of the sales in 2022 with the models Corolla Cross and Corolla Altis – both hybrid flex fuel vehicles, with starting prices of US$40340,69 and US$37486,75, respectively [29]. This shows that the trend of EVs growing as a market of luxury items in Latin American is confirmed in Brazil [58].

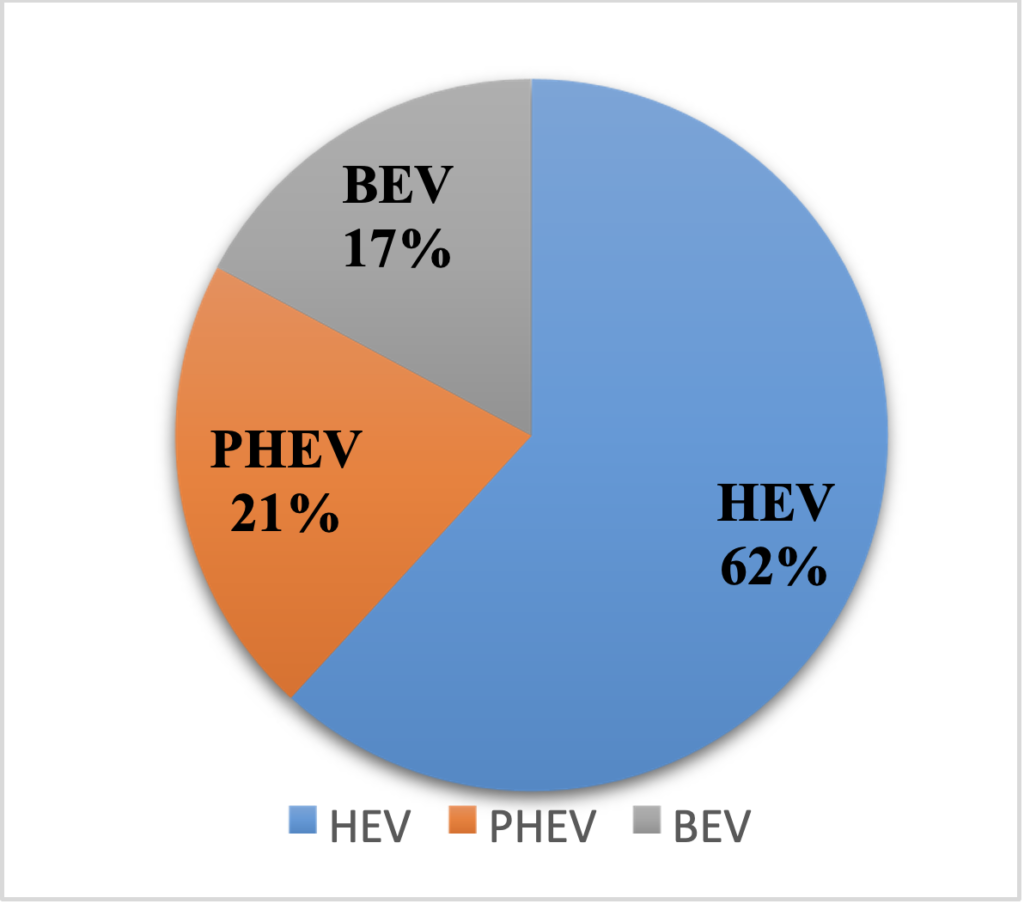

Although the growth in the region and in the country has been significant, EVs are still a small fraction of the market in Brazil, answering for 2,5% of the sales in 2022 and only 0,2% of the total fleet [6; 58]. In 2022 the sales of BEV and HEV have grown, respectively, from 2851 and 20274 in 2021 to 8458 and 30439 in 2022, while PHEV sales dropped from 11865 to 10348 in the same period [55]. The EV sales in 2022 in Brazil can be observed in Figure 2.

Figure 2 – EV sales in Brazil in 2022

This shows that, although BEV sales have increased, so have the HEV market share, reflecting a trend that can be observed throughout Latin America and EU, where HEV begin to pose a risk of technological lock-in. In EU consumers will experience a 14% disadvantage in terms of Total Cost of Ownership (TCO) for each average HEV that enters the market instead of a BEV vehicle in 2025 [59].

If HEVs are gaining market share in the UE, where BEVs already present the lowest TCO, in Brazil, where the charging infrastructure is still sparse, BEVs face an even bigger obstacle that adds to the high price of the vehicle [59]. In China BEVs are already competitive when compared to ICE vehicles, as a result from the firms conduct, and in the United States the gap between the prices of EVs and ICE vehicles is closing [3; 60].

The performance of these markets was, however, largely boosted by public policies that contributed to a market structure conducive for traditional ICE vehicle companies to enter and largely invest in the EVs market.

4. Discussion

Brazil is a large country that relies heavily on road transport. The lack of a comprehensive charging infrastructure combined to the long distances that are normally traveled by car add to the consumer’s resistance in trusting entirely electric vehicles. This scenario contributes to the growth in hybrid models in the EV market, following the trend observed throughout Latin America.

Flex fuel hybrid vehicles are further supported by Brazil’s strategy of mitigating GGE in the transport sector by increasing the production and use of biofuels, along with local initiatives of investment in the development of hybrid models – like the R$1 billion of credit granted to Toyota by the state of São Paulo [61], contributing to the advance of hybrids and the maintenance of the high market concentration.

A scenario where both public and private initiatives and investments support the development of hybrid models is prone to delaying the expansion of the charging infrastructure necessary for BEVs. In the long run, this can increase consumer’s mistrust in BEVs, setting hybrids as the undisputed market leaders and contributing to a technologic lock-in.

Even the advance of hybrids is, however, limited by the high prices of EVs. In more developed EV markets, such as EU, North America, and China the advance of EVs was heavily encouraged by public policies – purchase incentives, financing programs for private and public charging infrastructure, goals to end sales of ICE vehicles in the future, incentives to research and development – creating a market structure fruitful for companies and consumers to make the switch from ICE vehicles to EVs.

In Brazil, however, EVs still come second to biofuels in national strategy – a fact confirmed by the absence of electric mobility goals in national innovation and climate change programs, such as Inovar-Auto and National Climate Change Policy, with electric mobility missing even from the country’s NDC [10]. Brazil’s investment in biofuels through the RenovaBio program is not a surprise, consisting in the most recent step in a long history of biofuel incentive programs [62; 63].

The strategy could, however, hinder the country’s own efforts against climate change, since further expanding the production of biofuels could lead to and indirect increase in emissions [63; 64] while delaying Brazil’s inevitable integration to the international market [21].

5. Conclusions

Around the globe the global mobilization against climate change contributed to exponential growth in the EVs market, with many countries embedding electric mobility goals in their mitigation strategies.

In Brazil the absence of a legal and institutional framework for EVs and the necessary charging infrastructure combined with the high prices, delay in patent granting, and absence of a sound waste management policy to deal with batteries threaten the expansion of electric mobility and diminish the environmental benefits that could derive from its deployment – especially in a country with a highly renewable electric matrix.

The market structure is particularly distinguished by political, economic, and social aspects that foster firm’s conducts that differ from those successfully adopted in more developed markets. This scenario hinders the market’s performance, delaying the development of accessible EVs and restraining the market to a small percentage of high-income consumers.

Author Contributions: Conceptualization, Isabela Oliveira and Luan Santos; methodology, formal analysis, investigation, data curation and writing – original draft preparation, Isabela Oliveira; writing—review and editing, visualization, supervision, and project administration, Luan Santos; funding acquisition, Luan Santos. All authors have read and agreed to the published version of the manuscript.

Acknowledgments: The authors would like to thank EDP for funding the project “Desenvolvimento de Soluções para Operação Nacional de Mobilidade Elétrica: Mobilidade Elétrica Centrada no Utilizador”, developed under the R&D program regulated by ANEEL (Agência Nacional de Energia Elétrica).

References

- World Economic Forum. The Global Risks Report 2023 18th Edition. www.weforum.org (2023).

- IEA. Global Electric Vehicle Outlook 2022 – Securing supplies for an electric future. www.iea.org/t&c/ (2022).

- IEA. Oil Market Report – April 2023. https://www.iea.org/reports/oil-market-report-april-2023 (2023).

- Brasil. Projeto de Lei n° 403, de 2022. Preprint at https://www25.senado.leg.br/web/atividade/materias/-/materia/151951 (2022).

- Amatucci, M. & Spers, E. E. The Brazilian biofuel alternative. International Journal of Automotive Technology and Management 10, 37–55 (2010).

- Sindipeças. Relatório da Frota Circulante. https://www.sindipecas.org.br/sindinews/Economia/2023/RelatorioFrotaCirculante_2023.pdf (2023).

- Baran, R. & Legey, L. F. L. The introduction of electric vehicles in Brazil: Impacts on oil and electricity consumption. Technol Forecast Soc Change 80, 907–917 (2013).

- EPE. Balanço Energético Nacional 2022. https://www.epe.gov.br/sites-pt/publicacoes-dados-abertos/publicacoes/PublicacoesArquivos/publicacao-675/topico-631/BEN_S%C3%ADntese_2022_PT.pdf (2022).

- Grangeia, C. & Santos, L. O cenário atual da Indústria do Petróleo no Brasil e as oportunidades para os veículos elétricos. https://gesel.ie.ufrj.br/publicacao/o-cenario-atual-da-industria-do-petroleo-no-brasil-e-as-oportunidades-para-os-veiculos-eletricos/ (2021).

- Consoni, F. L. et al. Estudo de Governança e Políticas Públicas para Veículos Elétricos. www.giz.de/brasil (2018).

- Ellis, J. & Rypl, N. C. 2030 Brazil Roadmap Multiplying the Transition: Market-based solutions for catalyzing clean energy investment in emerging economies. (2021).

- Scarano, P. R., Muramatsu, R., Silva, A. & Francischini, N. Modelo estrutura-conduta-desempenho como esquema analítico de análises setoriais. in Estudos econômicos setoriais: máquinas e equipamentos, ferrovias, têxtil e calçados (2019).

- Boru, T. & Kuhil, A. M. The Structure Conduct Performance Model and Competing Hypothesis-a Review of Literature Determinants of Bank Selection choices and customer Loyality the case of Ethiopian Banking Sector View project Aftermaths of Demonetization in Ethiopia View project. www.iiste.org (2018).

- de Sousa, G. C. & Castañeda-Ayarza, J. A. PESTEL analysis and the macro-environmental factors that influence the development of the electric and hybrid vehicles industry in Brazil. Case Stud Transp Policy 10, 686–699 (2022).

- Alanzi, S. Pestle Analysis Introduction. https://www.researchgate.net/publication/327871826 (2018).

- Carruthers, H. Using PEST analysis to improve business performance. In Pract 31, 37–39 (2009).

- Johnson, G., Scholes, K. & Whittington, R. O Ambiente. in Fundamentos de Estratégia 45–80 (2011).

- Resende, M. & Boff, H. Concentração Industrial. in (eds. Kupfer, D. & Hasenclever, L.) (Elsevier, 2013).

- Wood, B., Williams, O., Baker, P., Nagarajan, V. & Sacks, G. The influence of corporate market power on health: exploring the structure-conduct-performance model from a public health perspective. Globalization and Health vol. 17 Preprint at https://doi.org/10.1186/s12992-021-00688-2 (2021).

- Santos, L. & Grangeia, C. Experiências Internacionais em Mobilidade Elétrica. (2021).

- De Castro, N., Brandão, R. & Moszkowicz, M. A eletrificação da indústria automobilística do Brasil. https://gesel.ie.ufrj.br/publicacao/a-eletrificacao-da-industria-automobilistica-do-brasil/ (2021).

- IPEA. Carta de Conjuntura – Visão Geral da Conjuntura. https://www.ipea.gov.br/cartadeconjuntura/index.php/2022/12/visaogeral-da-conjuntura-17/ (2023).

- Banco Central do Brasil. Relatório de Mercado. (2023).

- Our World In Data. Population & Demography Data Explorer – Our World in Data. https://ourworldindata.org/explorers/population-and-demography?tab=table&time=latest&facet=none&country=CHN~IND~USA~IDN~PAK~NGA~BRA~RUS~BGD~MEX&pickerSort=desc&pickerMetric=population__all__all__records&Metric=Population&Sex=Both+sexes&Age+group=Total&Projection+Scenario=None (2022).

- IBGE. PIB cresce 2,9% em 2022 e fecha o ano em R$ 9,9 trilhões. (2023).

- Grangeia, C. et al. Energy transition scenarios in the transportation sector in Brazil: Contributions from the electrical mobility. Energy Policy 174, 113434 (2023).

- De Castro, N., Gonçalves, L. & Tostes, C. A importância das smart grids de eletricidade na transição energética 1. https://energia.aebroadcast.com.br/tabs/news/747/43831391. (2023).

- IRENA. ELECTRIC-VEHICLE SMART CHARGING INNOVATION LANDSCAPE BRIEF. www.irena.org (2019).

- ABVE. 100 mil eletrificados já circulam no Brasil. (2022).

- Glensor, K. & María Rosa Muñoz, B. Life-cycle assessment of Brazilian transport biofuel and electrification pathways. Sustainability (Switzerland) 11, (2019).

- Kaunda, R. B. Potential environmental impacts of lithium mining. Journal of Energy and Natural Resources Law 38, 237–244 (2020).

- Sun, J. et al. Toxicity, a serious concern of thermal runaway from commercial Li-ion battery. Nano Energy 27, 313–319 (2016).

- PNME. 2o Anuário Brasileiro da Mobilidade Elétrica. (2022).

- Cabral-Neto, J. P., de Mendonça Pimentel, R. M., Santos, S. M. & Silva, M. M. Estimation of lithium-ion battery scrap generation from electric vehicles in Brazil. Environmental Science and Pollution Research 30, 23070–23078 (2023).

- ABVE. Eletromobilidade – Sinais positivos do novo governo. http://www.abve.org.br/abve-ve-novas-possibilidades-para-a-eletromobilidade-no-governo-lula/ (2023).

- Brasil. Governo prevê investimento de R$50 bilhões em transição energética. https://www.gov.br/pt-br/noticias/energia-minerais-e-combustiveis/2023/03/ (2023).

- Furtado, G. F., Boeing, R., Almeida, Q. M., Sousa, A. M. R. & Santos, R. C. Dos. Influence factors of consumers’ decision-making: the behavioral perspective on car buying. ReMark – Revista Brasileira de Marketing 22, 223–300 (2023).

- IBGE. Produto Interno Bruto – PIB. (2023).

- Pagani, P. A. S., Firme, V. de A. C. & Santos, M. de A. D. Determinantes da demanda do setor automobilístico brasileiro: uma análise empírica. Estud Econ (Sao Paulo) 52, 613–645 (2022).

- Buranelli de Oliveira, M., Moretti Ribeiro da Silva, H., Jugend, D., De Camargo Fiorini, P. & Paro, C. E. Factors influencing the intention to use electric cars in Brazil. Transp Res Part A Policy Pract 155, 418–433 (2022).

- Ruoso, A. C. & Ribeiro, J. L. D. An assessment of barriers and solutions for the deployment of electric vehicles in the Brazilian market. Transp Policy (Oxf) 127, 218–229 (2022).

- Biresselioglu, M. E., Demirbag Kaplan, M. & Yilmaz, B. K. Electric mobility in Europe: A comprehensive review of motivators and barriers in decision making processes. Transp Res Part A Policy Pract 109, 1–13 (2018).

- Cansino, J. M., Sánchez-Braza, A. & Sanz-Díaz, T. Policy instruments to promote electro-mobility in the EU28: A comprehensive review. Sustainability (Switzerland) 10, (2018).

- Capgemini. Key factors defining the e-mobility of tomorrow. https://www.capgemini.com/wp-content/uploads/2019/02/Capgemini-Invent-EV-charging-points.pdf (2019).

- Sovacool, B. K., Abrahamse, W., Zhang, L. & Ren, J. Pleasure or profit? Surveying the purchasing intentions of potential electric vehicle adopters in China. Transp Res Part A Policy Pract 124, 69–81 (2019).

- ANFAVEA. Anuário da Indústria Atuomobilística Brasileira. https://acervo.anfavea.com.br/AcervoDocs/Anu%C3%A1rio%20ANFAVEA%202022-422-0.pdf (2022).

- Zhang, X., Liang, Y., Yu, E., Rao, R. & Xie, J. Review of electric vehicle policies in China: Content summary and effect analysis. Renewable and Sustainable Energy Reviews vol. 70 698–714 Preprint at https://doi.org/10.1016/j.rser.2016.11.250 (2017).

- Farjana, S. H., Huda, N. & Mahmud, M. A. P. Life cycle assessment of cobalt extraction process. Journal of Sustainable Mining 18, 150–161 (2019).

- Dall-Orsoletta, A., Ferreira, P. & Gilson Dranka, G. Low-carbon technologies and just energy transition: Prospects for electric vehicles. Energy Conversion and Management: X 16, (2022).

- Oliveira, L. et al. Key issues of lithium-ion batteries – From resource depletion to environmental performance indicators. J Clean Prod 108, 354–362 (2015).

- Perkins, G. & Murmann, J. P. What Does the Success of Tesla Mean for the Future Dynamics in the Global Automobile Sector? Management and Organization Review vol. 14 471–480 Preprint at https://doi.org/10.1017/mor.2018.31 (2018).

- Stringham, E. P., Miller, J. K. & Clark, J. R. Overcoming Barriers to Entry in an Established Industry: TESLA MOTORS. (2015).

- Cho, M. J. & Shin, J. Identifying a Combination of Key Resources to Overcome the Entry Barriers in the Electric Vehicle Market. IEEE Access 10, 60373–60386 (2022).

- IEA. Global EV Outlook 2023: Catching up with climate ambitions. www.iea.org (2023).

- Fiat. Back With New Energy. https://www.fiatusa.com/500e-reveal.html (2022).

- Volkswagen. World premiere of the ID. 2all concept – The electric car from Volkswagen costing less than 25,000 euros. (2023).

- US News. Toyota to invest 338 million in new hybrid flex car in Brazil. https://money.usnews.com/investing/news/articles/202304-19/ (2023).

- INPI. Veículos Elétricos e Híbridos Panorama Patentário no Brasil. (2018).

- EPBR. Mercado de carros elétricos no Brasil cresceu 58% no primeiro semestre. (2023).

- Element Energy. Electric Cars: Calculating the TCO for Consumers. www.just-auto.com/news/vw-group-platform-strategykey-to-e-mobility-rollout_id200799.aspx (2021).

- ICCT. Assessment of light-duty electric vehicle costs and consumer benefits in the United States in the 2022-2035 time frame. (2022).

- Laguna, E. & Luiz, B. Devolução de ICMS vai permitir a Toyota produzir carro híbrido em SP. CNN (2023).

- Grassi, M. C. B. & Pereira, G. A. G. Energy-cane and RenovaBio: Brazilian vectors to boost the development of Biofuels. Ind Crops Prod 129, 201–205 (2019).

- Pavlenko, N. & Araujo, C. Opportunities and risks for continued biofuel expansion in Brazil SUMMARY. www.theicct.org (2019).

- Marx, R. & Marotti De Mello, A. New initiatives, trends and dilemmas for the Brazilian automotive industry: the case of Inovar Auto and its impacts on electromobility in Brazil. Int. J. Automotive Technology and Management vol. 14 (2014).

¹Production Engineering Program, Federal University of Rio de Janeiro. Correspondence: isabela.oli@ufrj.br

²Faculty of Business Administration and Accounting Sciences, Federal University of Rio de Janeiro.